business-services

May 14,2025 • 6 min read

How Can Virtual Phone Number Enhance Banking Services in India?

In recent years, the banking industry in India has seen a massive shift towards digitalization, with customers demanding faster, more secure, and personalized services. One such innovation that has greatly impacted the banking sector is the use of virtual phone numbers. These virtual numbers offer numerous benefits, including enhanced security, better customer service, and greater operational efficiency for banks.

In this article, we’ll explore how virtual phone numbers can enhance banking services in India, and why partnering with the best virtual phone number service provider in India can be a game-changer.

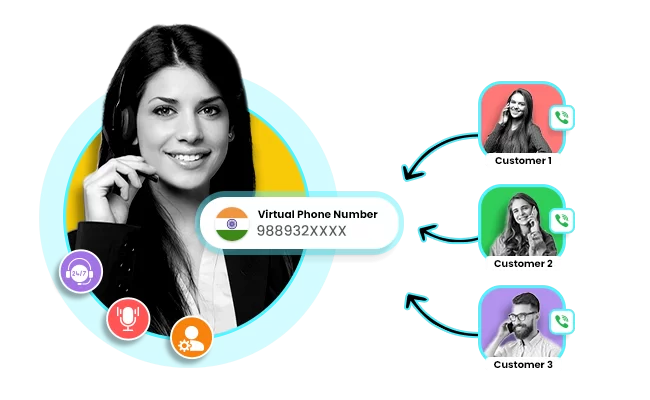

What is a Virtual Phone Number?

A virtual phone number is a cloud-based number that doesn’t require a physical phone line or SIM card. These numbers can be used for receiving calls and SMS messages, and they can be linked to any device, whether a smartphone, desktop, or VoIP system. Virtual phone numbers are not tied to a specific geographic location, which makes them highly flexible for businesses, including banks, to offer services across India and globally.

Benefits of Virtual Phone Numbers for Indian Banks

1. Enhanced Customer Security

In an era of increasing cyber threats and data breaches, security is a top priority for banks and their customers. Virtual phone numbers play a crucial role in ensuring enhanced security. By using a virtual phone number for OTPs (One-Time Passwords) and transaction alerts, banks can provide a more secure channel for customers to verify their identity and transactions.

Moreover, virtual phone numbers are not tied to a specific user’s personal number. This means that even if a customer’s primary phone number is compromised, their virtual number can still provide a separate, secure line for banking communications.

2. Improved Customer Service

Customer service is a key differentiator in the competitive banking industry. Virtual phone numbers enable banks to provide a more personalized and professional customer experience. Banks can set up dedicated virtual numbers for different customer queries, whether it's for account inquiries, loan applications, or fraud alerts. This segregation helps streamline the communication process, making it easier for customers to reach the right department.

Additionally, virtual numbers allow for call forwarding to different agents or departments based on the customer’s needs, thus reducing wait times and improving response rates.

3. Cost-Effective Solution

Setting up traditional phone lines for customer service and other banking operations can be expensive, especially for banks with multiple branches or regional offices. Virtual phone numbers, on the other hand, are a cost-effective solution, eliminating the need for expensive hardware or telecom infrastructure. Banks can allocate virtual numbers to different regions, thus offering local numbers to customers across India, without the associated costs of setting up a physical line.

Moreover, virtual numbers come with various plans that are scalable according to the bank's growing needs. This makes them an ideal solution for both small and large banking institutions.

4. Seamless Multi-Channel Communication

In today’s fast-paced world, customers expect seamless communication across multiple channels. Virtual phone numbers enable banks to engage customers via SMS, voice calls, and even WhatsApp, all under one unified system. This multi-channel approach improves accessibility and ensures that customers can reach their banks using the most convenient platform for them.

For instance, banks can integrate virtual phone numbers with their online banking systems, offering customers the ability to receive alerts, track transactions, and even resolve issues through text messages or voice calls.

5. Support for Multi-Language Communication

India is a diverse country with people speaking different languages across regions. Banks can use virtual phone numbers to offer services in multiple languages by integrating local language support. Whether it's sending SMS alerts or conducting phone conversations, virtual phone numbers can be configured to accommodate various languages, ensuring that customers from all corners of India receive communication in their preferred language.

This enhances the customer experience and increases customer satisfaction, as clients can interact with the bank in a way that feels personal and relevant to them.

How Virtual Phone Numbers Improve Banking Operations

1. Efficient Fraud Prevention

Fraudulent activities are a major concern for the Indian banking sector. Virtual phone numbers can be leveraged to provide two-factor authentication (2FA) for all transactions, adding an additional layer of protection for customers and banks alike. As virtual numbers are not tied to any physical location or device, they are less vulnerable to hacking and SIM swapping attacks, making them a more secure option for banking transactions.

2. Automated and Personalized Banking Services

Banks can use virtual phone numbers to automate customer interactions, sending personalized reminders for bill payments, loan due dates, or special offers. These numbers can be set up to automatically send customized SMS messages to customers, improving engagement without human intervention. This level of automation helps banks save time and resources while delivering a more personalized experience for each customer.

3. Streamlined Account Management

Virtual phone numbers enable easy management of multiple customer accounts. Since these numbers can be assigned to specific departments, teams, or services, customers can be routed to the appropriate department without manual intervention. This reduces errors, enhances customer satisfaction, and streamlines banking operations, helping banks improve both internal efficiency and external service quality.

Conclusion

Virtual phone numbers are revolutionizing the way Indian banks interact with their customers. From enhancing security and providing multi-channel communication to improving customer service and reducing operational costs, the benefits are undeniable. As the banking sector continues to evolve, integrating virtual phone numbers into the service offerings is no longer optional but essential for staying ahead in the competitive market. By choosing the best virtual phone number service provider in India, banks can ensure they are providing secure, efficient, and personalized services to their customers, paving the way for a smarter, safer banking experience in India.

SpaceEdge Technology: Digital Marketing Service Provider

SpaceEdge Technology is a leading digital marketing service provider in India, offering comprehensive solutions like SEO, PPC, SMO, and bulk SMS. With over 15 years of experience, their expert team crafts data-driven strategies to boost online visibility and drive conversions. Trusted by businesses nationwide, SpaceEdge ensures measurable results through innovative, tailored digital campaigns.

marketingworld Details

User Profile

- Full name

- marketingworld

- Email address

- ankush.spaceedgeseo@gmail.com

- Join Date

- 2025-05-08

- State

- City

- Pincode

- Address

- Follow us on Facebook

- Follow us on Twitter

- Website Name

- Bio